Engulfing Candlestick

The engulfing candlestick pattern is a popular chart pattern used in technical analysis to identify potential trend reversals. It consists of two candles and suggests a shift in market sentiment from bullish to bearish or vice versa.

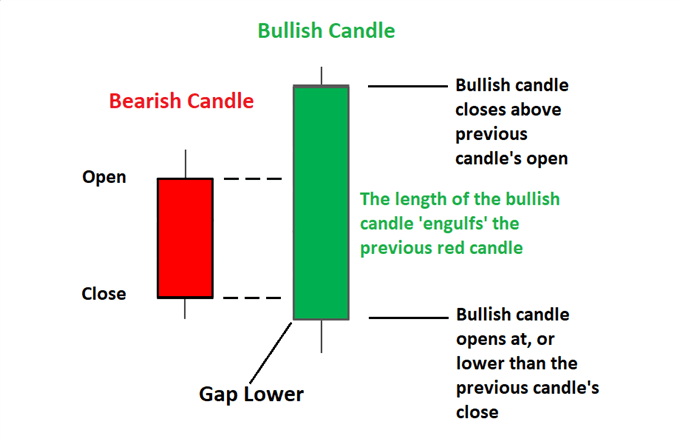

Basic chart

The first candle must be a down candle, be large or small. The key to the pattern is the size of the second candle. The second candle will need to engulf or overlap the first candle, this means the opening price for the second candle must be lower than the closing price of the first candle.

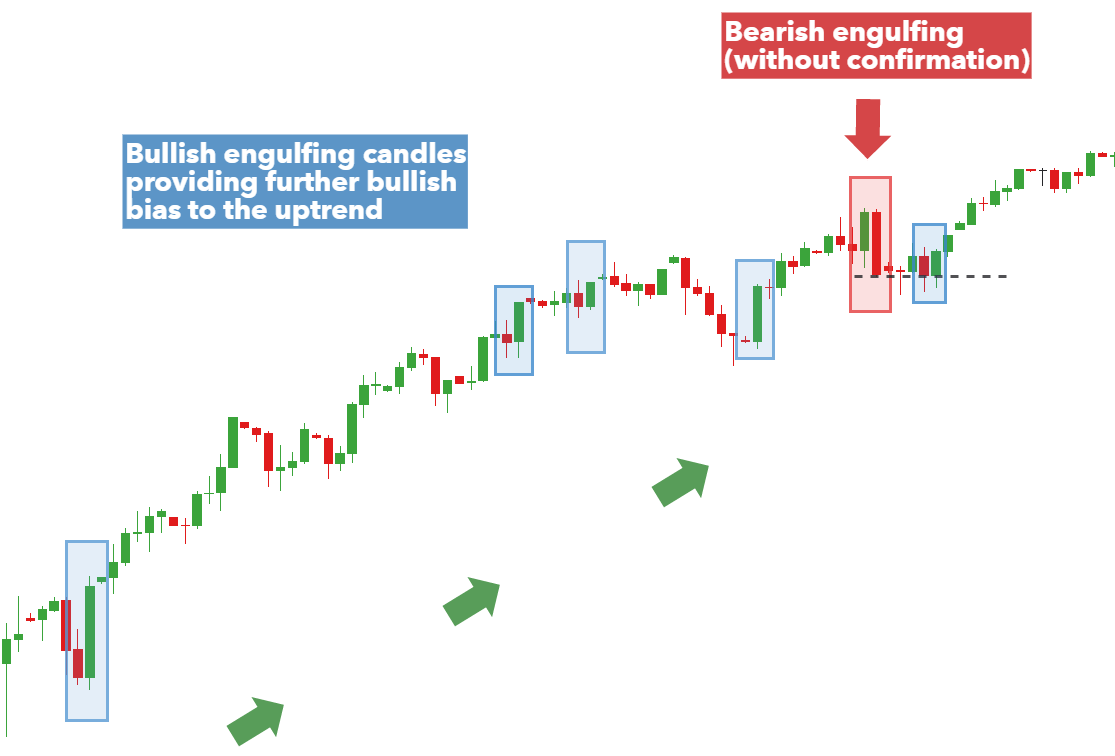

Confirmation

Traders typically wait for the next candle after the engulfing pattern to confirm the reversal. They look for a further decline in price after a bearish engulfing pattern or an upward move after a bullish engulfing pattern.

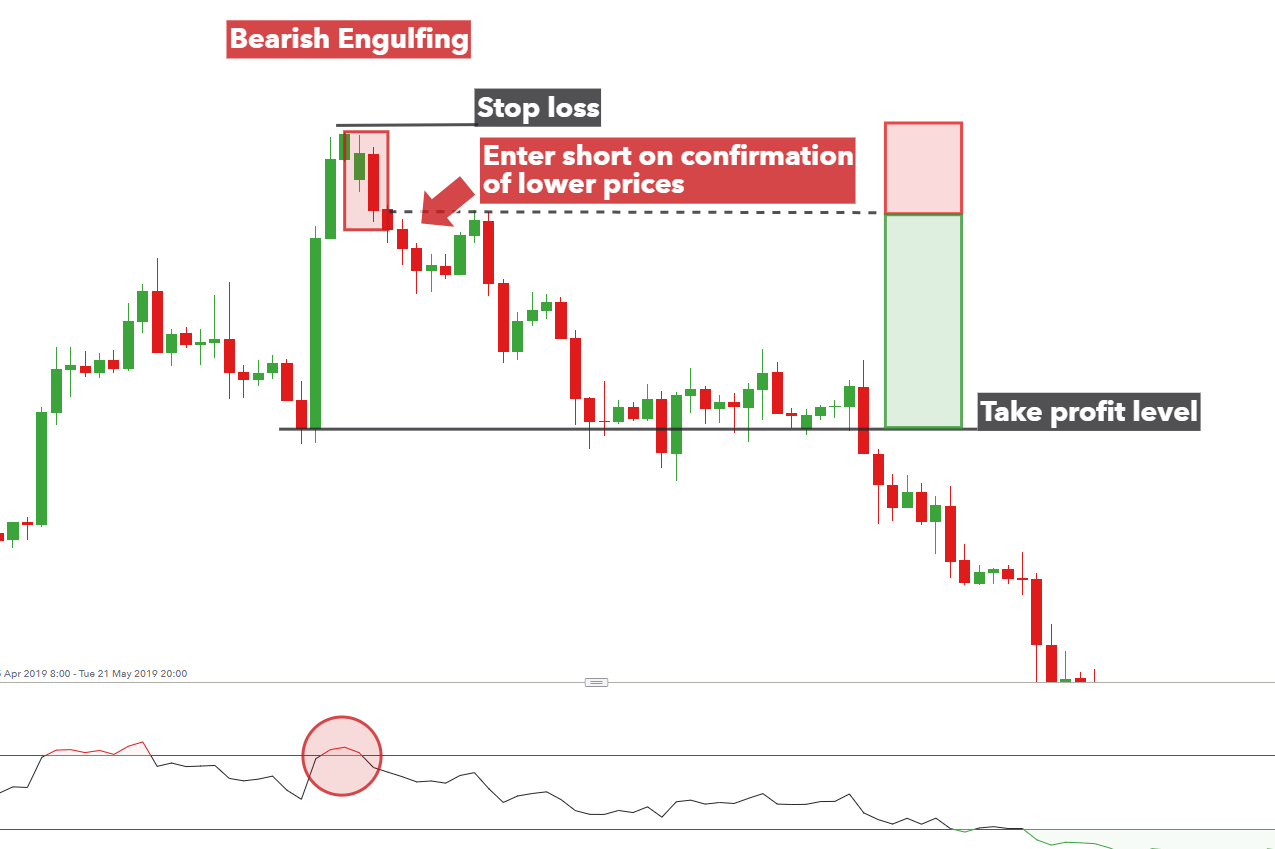

Target bearish engulfing

Stop-loss orders can be placed below the low of a bullish engulfing pattern or above the high of a bearish engulfing pattern to manage risk.

Target bullish engulfing

This pattern occurs during a downtrend and consists of a small bearish candle followed by a larger bullish candle that completely engulfs the previous candle's body. The bullish candle indicates that buying pressure has overwhelmed selling pressure.